AePS

Aadhaar Enabled Payment System – MGNREGS – Payment through APB (AePS)

- Introduction

Aadhaar Enabled Payment System for NREGS payments is introduced in Krishna District with a view to improve transparency and efficient fund transfer system. The Aadhaar Enabled Payment System (AePS) is being implemented under NREGA in Krishna District since April-2016 with an objective to ensure timely payments to genuine wage seekers through Aadhaar authentication.

Under Aadhaar enabled Payment System, the NREGA payments are credited to the bank accounts of the individuals utilizing the data base of job cards and fund transfer orders from NREGA server and are disbursed through Micro ATMs through Aadhar based biometric authentication of the wage seekers. Further for wage seekers who do not have the bank accounts, accounts are opened at their door step under eKYC mode through micro ATMs.

- Objectives

- To improve transparency in NREGS payments by depositing the wages directly into the bank accounts of the wage seekers enhancing their financial inclusion.

- To ensure timely and correct payments to the wage seekers

- To avoid fudging of musters and fake musters by Aadhaar authentication

- To disburse payments at the door step of the wage seekers

- To monitor the payment flow effectively.

- Origin

Considering successful implementation of the pension distribution in Krishna District, the district administration has introduced this system under NREGA payments initially in 361 GPs. The Micro ATMs that are in operation for pension distribution can be utilized for these payments also, there is no extra cost involved for infrastructure. Further there are around 5 lakh active wage seekers in the district, drawing payments under NREGA throughout the year and to ensure timely payments, the system has been introduced in the district. APB Payment Process to wage seekers piloted in entire Krishna District. It has the total transactions of 1,44,982 to 61,399 wage seekers with an amount of Rs.9.31 Crores processed so far and transferred to wage seekers’ Bank Accounts on Aadhaar based attendance for wage seekers.

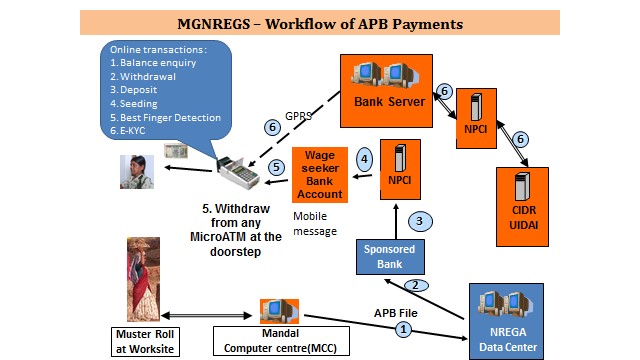

- Process flow

Under Direct Benefit transfer system, payments under NREGS are made to the individual bank accounts of wage seekers based on the Aadhaar number through Aadhaar Payment Bridge. To achieve this,

- The wage seeker has to seed his Aadhaar number into the NREGA data base at Block level.

- Wage seeker has to seed his Aadhaar number with his bank account in which the wages are to be credited. In case of no bank accounts, new accounts are opened through a simple eKYC process.

- Bank has to seed the Aadhaar number with the National Payment Corporation of India (NPCI) mapper. This completes the linkage of aadhaar and bank account.

- When the NREGS programme officer sends a fund transfer order request, it goes to the NREGS central server and from there, money gets credited to sponsor bank.

The flow chart is shown below

.jpg)

- Payment to the NREGA wage-seekers

In each Gram panchayat, one Banking Correspondent is appointed with a Micro ATM. The machine has a finger print and Iris scanner with interoperability. The details of Aadhaar of the wage seekers and payment details are enabled in the machine. The payments are made to the wage seeker based on his/her biometric authentication.

- Coverage

Initially the system was introduced in 361 GPs and now it is being implemented in 751 GPs in the district covering 4.2 lakh wage seekers. So far an amount of Rs.28.45 crores was credited into the accounts of the wage seekers. Now it is proposed to extend this to another 25 GPs and soon NREGS payments will be disbursed through AePS in all the 970 GPs in the District.

- Benefits of the AePS system

- The benefit or NREGA payment goes to the genuine beneficiary.

- The beneficiary can withdraw/ receive the payments of any bank from the same ATM.

- Timely payments without any delays are assured as the amount is credited to the wage seeker accounts directly. As majority of NREGS beneficiaries are rural poor, this has a tremendous impact in their family economy.

- Duplicate musters and any other fraudulent practices are avoided as payments being disbursed through Aadhar based biometric authentication.

- Besides, the beneficiary can open a bank account in eKYC mode without going to the bank.

- Biometric Attendance

In Krishna District, a new initiative in the form of Bio metric attendance to the NREGS wage seekers is introduced to bring in accountability and transparency in the scheme. Biometric attendance system is introduced as pilot in place of electronic musters in with an objective to avoid fake musters and to deliver the benefit to the genuine wage seeker. In this process,

- The biometric i.e finger prints and iris of the wage seekers as in the Aadhar data base are provided in the software in POT machine.

- When the wage seeker attends work in the work site, his biometrics are captured in the machine and are verified with the data available in the Aadhar data base.

- If the biometrics are tallied, then the attendance is captured automatically and sent to MCC server directly for payments.

- With this, fake musters will be avoided and delay in data entry and human errors are avoided.

- Flow Chart of APB Payments