Disbursement of Pensions

Author:

Babu.A, IAS, Collector, Krishna District, AP,

Time:

2016-11-01 16:22:17

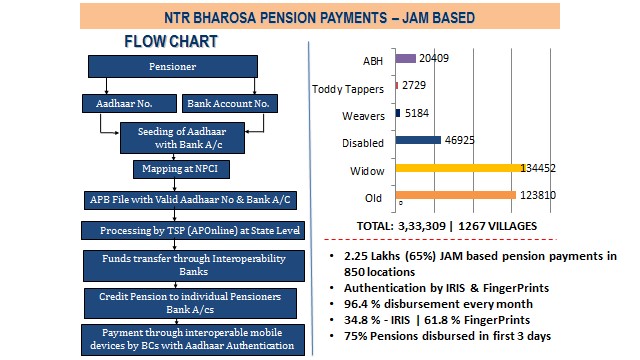

Disbursement of Pensions through JAM Based

- Objective: To ensure timely disbursement of Pensions for providing Social Security to all the poor and vulnerable (particularly the old and infirm) and to support their minimum needs in their lives. The Pension disbursement is happening in the entire Krishna District in all the 49 Blocks, 8 Municipalities and 1 Municipal corporation. The following are the types of pensions disbursed through JAM based Interoperable Micro ATMs. Old Age Pension, Widow Pension, Disabled Pension, Weavers Pension and Toddy Tappers Pension. The total number of Pensioners in the State is around 43 lakh and the spending on Social Security Pensions is around Rs.460 Cr per month and Rs.5000 Cr per year.

- Current Status: As against the total no. of 3.33 lakh pensioners in Krishna District, 2.79 lakh pensioners have been brought into the fold of new project, amounting to 84%. The balance will also be covered in next one or two months. Nearly Rs.30.00 Cr is being disbursed under new project as against the total disbursement of around Rs.35.00 Cr. Positioning of Business Correspondents (BCs) has been completed up to 95%.

- Biometric Authentication: The Pension amount is provided to the beneficiaries based on their biometric authentication. Each Business Correspondent (BC) is provided with a Finger Print Reader. Efforts are being made to authenticate the pensioners through Iris Device also. This enables for identification of the beneficiary based on his / her fingerprint or Iris.

- Pilot and Scale-up: A pilot was initially conducted in Krishna District based on the learning’s from the pilot, the program was scaled up to the entire state of Andhra Pradesh.

5.Technology Platform used:

Description: Micro ATMs - Different banks are using different technologies as per their contract agreements with their Service Providers. Some banks are using Kiosk Model (SBI).

Interoperability: The Banks which were enabled with Aadhaar Enabled Payment System (AePS) are participating in this mode of pension payments in Krishna District.

- Coverage:

- Business Correspondents (BCs) have been positioned in 1243 locations out of 1269.

- 2, 79,179 Pensions are being disbursed through Business Correspondents (BCs) against the total Pensions of 3, 33,612.

- The Pensioners are disbursed with their pension through Business Correspondents (BCs) as per their requirement using the Interoperable Micro ATMs which have the facility for Balance Enquiry, Withdrawal (Debit), Deposit (Credit) and Fund Transfer.

- Totally under this system, 24 Banks have been identified for participation so far in Krishna District. 13 Banks are participating in the system as of now. If anybody does not have a Bank Account, then a new Bank Account (PMJDY) will be opened.

- Out of 878 BCs positioned so far to cover 1243 locations in the District, 273 BCs have been provided by the Bankers and the 605 BCs have been provided by DRDA by selecting the eligible through a written examination from among the SHGs

- Adaptability and Scalability: The program was initially started in just 6 locations in two (2) Mandals for payment of 198 Pensions amounting to Rs 2.01 Lakh in March 2015 with only one Bank that came forward. But, now it has been expanded covering 1243 locations involving 2.79 lakh pensioners (84% of the total Pensioners) and nearly Rs.30.00 crore per month with the participation of 13 Banks.

- Impact on end users

- The disbursement of pension amount is happening at the doorsteps of the beneficiaries. They need not go out to draw or receive the pension amount.

- As the pension amount is credited into the Bank Accounts of the Pensioners and the BCs are available in the Villages / Wards, the pensioners are able to withdraw the amount as per their absolute requirement, leaving the balance in the bank accounts as savings. That way, the savings habit is being inculcated.

- As majority of the pensioners have the PMJDY Bank accounts which are kept in active mode due to the transactions concerning the pensions, the pensioners are becoming indirectly entitled to insurance benefits as announced by the Government and also to make use of the facility of overdraft up to the prescribed amount of Rs.5,000/-.

- Distinctive feature of the Project: The pilot project is implemented vigorously in Krishna District of Andhra Pradesh. It has attracted the attention not only from the Government of India, UIDAI and other State Governments but also from the World Bank, Tanzanian Government, Bill Gates Foundation and they had visited the District to have first-hand information on this project.

- Flow Chart of Pensions payment – JAM Based